Summarize this Article with:

RTGS full form in banking | What is it and how can it benefit you?

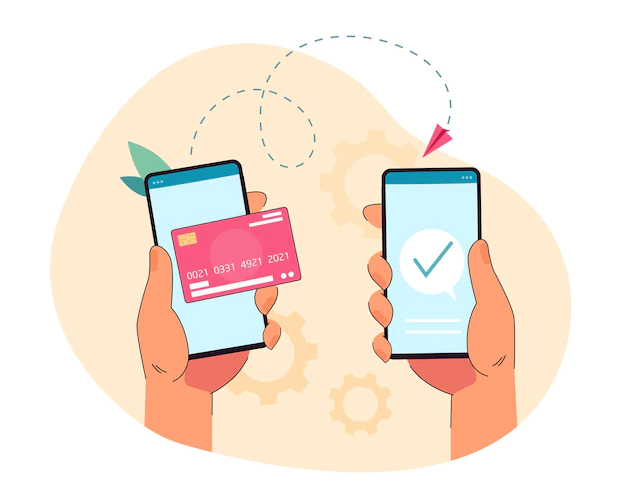

If you’ve ever been to a bank, you’ve probably heard of RTGS. But what is RTGS, and how can it benefit you? RTGS stands for Real-Time Gross Settlement. It’s a system that banks use to transfer money between one another. The benefits of RTGS are many, but some of the most notable are its speed, transparency, and security. Here, I’d like to examine these advantages one by one.

What is RTGS?

RTGS stands for Real-Time Gross Settlement and is a system used by banks to transfer large sums of money. The funds are transferred almost immediately, making it ideal for urgent or time-sensitive payments. RTGS is a safe and efficient way to move money, and because it is paperless, it also helps to reduce costs. In most cases, RTGS payments will be processed within 30 minutes. while in some cases it may take up to 2 hours. Banks typically have their cut-off times for RTGS payments, so it’s important to check with your bank to see when the funds will be available.

RTGS is available 24 hours a day, seven days a week, except on certain bank holidays. When making an RTGS payment, you will need to provide the recipient’s name, account number, and bank details. You will also need to specify the amount you wish to pay. Once the payment has been processed, you will receive a confirmation from your bank. RTGS can be used for both local and international payments and is one of the fastest and most secure ways to move funds between banks.

Full form of RTGS?

RTGS Stands for Real-time gross settlement (RTGS), which is a transfer system where transactions amount is processed and settled in real time

How does RTGS work?

RTGS works by integrating with a bank’s existing infrastructure to provide a secure platform for transferring funds. When a customer initiates an RTGS transaction, the funds are transferred from the sending bank to the receiving bank in real time. The sender and receiver will typically receive confirmation of the transaction immediately.

To make an RTGS payment, you will need the following information:

– The name of the recipient bank

– The recipient’s account number

– The amount of money you wish to send

– The reason for the payment

– Your bank’s reference number for the transaction

– Your account numbers

Once you have this information, you can make an RTGS payment by logging into your online banking portal and following the instructions. Alternatively, you can visit your local branch and make the payment in person.

What Are the Benefits Of RTGS?

There are numerous benefits of using RTGS for customers and businesses alike. Some of these benefits include:

• Immediate availability of funds: One of the main advantages of RTGS is that it offers customers immediate availability of funds. Once a transaction has been made, the funds are immediately available for use by the recipient. This makes RTGS ideal for situations where time is of the essence, such as making payments for urgent medical treatment or paying for goods and services that need to be delivered urgently.

• Reduced risk of fraud: Another benefit of using RTGS is that it reduces fraudulent activities as all transactions are conducted through a central network that is monitored by a central authority such as a central bank. This makes it very difficult for criminals to commit fraud as they would need access to this central network.

• Increased efficiency: RTGS also helps to increase efficiency as it reduces errors and delays associated with other methods such as cheques or paper-based transfers. This is because all transactions are conducted electronically, eliminating human error and delays associated with manual processing.

• Improved liquidity management: For businesses, improved liquidity management is another big advantage of using RTGS. This is because businesses can manage their cash flow more effectively as they can plan their payments knowing that the funds will be available immediately once the transaction has been made.

What is the limit of RTGS Traction per day?

RTGS transactions have a minimum amount limit of Rs 2 lakh. The new limit for RTGS transactions is Rs 10 lakh or Rs 1 crore based on customer needs. The RBI has made this change to make sure that high-value transactions are made quickly and efficiently.

What is the difference between RTGS and NEFT- Which payment mode is better?

When it comes to transferring funds, there are two main types of systems: real-time gross settlement (RTGS) and national electronic funds transfer (NEFT). Both have their own advantages and disadvantages, so it’s important to understand the difference before choosing a payment method.

RTGS is a real-time system, which means that transactions are processed and cleared immediately. This makes it ideal for large or time-sensitive payments, as there is no risk of delay. However, RTGS is also more expensive than NEFT, as banks typically charge a higher fee for this service.

NEFT is a batch-processing system, which means that transactions are not processed in real-time. Instead, they are grouped together and processed in batches at set intervals throughout the day. This makes NEFT a more affordable option for small or regular payments. However, there is always a risk of delayed processing with this method, as transactions may be held up if there are too many payments in a particular batch.

Both RTGS and NEFT have their own advantages and disadvantages, so it’s important to choose the right payment method for your needs. If you need to make a large or time-sensitive payment, RTGS is the best option. However, if you’re looking to save money on transaction fees, NEFT may be the better choice.

Conclusion:

Overall, Real-time gross settlement (RTGS) systems offer significant advantages over other methods such as cheques or paper-based transfers. Some of these advantages include immediate availability of funds, reduced risk of fraud, increased efficiency, and improved liquidity management. If you need to make a large payment quickly, then RTGS may be your best option. However, it should be noted that RTGS payments can only be made during working hours. So, if you need to make a payment outside of working hours, then you may need to use an alternative method.

Hey kids, how much did you like RTGS full form in banking | What is it and how can it benefit you? Please share your view in the comment box. Also, please share this Full Form with your friends on social media so they can also enjoy it, and for more, please bookmark storiespub.com.

Suggested Article –

- What is the full form of IAS

- What is the full form of NATO?

- What Is The Full Form Of UPSC

- What is the OTT Full Form

- SOS: What Does It Stand For And Why Was It Chosen?

- What is the full form of OTP and why is it important?